H ave you been looking for a career change to make more money? If so, check out this guide to the best-paying jobs in real estate investment trusts.

Some of the best careers are found in unusual places. Real estate investment trusts, or REITs, are one of those places.

No, that’s not an industry most look to for rewarding careers, but maybe that’s why it provides plenty of top job opportunities. And that’s why we’re providing this guide to the best-paying jobs in real estate investment trusts.

This post is all about a career opportunity in REITs. Here’s how to make it happen.

What Is A Real Estate Investment Trust?

A real estate investment trust is an investment fund to invest in real estate.

This is typically commercial real estate. That means office buildings, retail space, warehouses, large apartment complexes, and other property types.

Investors purchase shares in a REIT in much the way you can buy stocks. Since REITs are legally required to distribute most of their income to shareholders, they are an excellent source of dividends.

However, many REITs also offer the potential for capital gains, providing a nice mix of growth and income.

Though not well known to the general public, it’s a large industry.

According to the National Association of Real Estate Investment Trusts (NAREIT), US-based REITs control $4.5 trillion in gross real estate assets and manage more than 535,000 properties.

Are Real Estate Investment Trusts A Good Career Path?

When considering a career path, it’s essential to explore industries that offer promising prospects and substantial job availability.

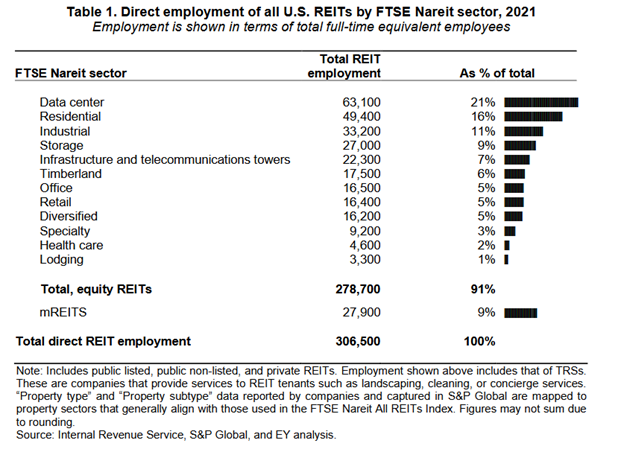

Real Estate Investment Trusts (REITs) undoubtedly fall into this category, boasting a thriving and expansive universe that generates over 300,000 jobs across the United States alone.

The sheer magnitude of the REIT industry is a testament to its potential.

With an impressive $22.7 billion in total wages paid out annually, it’s no wonder that the average salary in this field amounts to approximately $74,000 per year.

Such figures indicate the attractiveness and financial stability that can accompany a career within the realm of REITs.

Moreover, the spectrum of career opportunities within the industry is vast and diverse. REITs encompass a wide range of sectors, providing ample chances for professionals to explore their interests and find their niche.

Whether your passion lies in building service provision, computer facilities and management services, direct REIT management positions, warehouse and storage operations, telecommunications infrastructure, commercial logging, or advertising, the REIT industry has it all.

(Source: National Association of Real Estate Investment Trusts (NAREIT))

Furthermore, REITs operate within a vibrant ecosystem where collaboration and innovation thrive.

By being a part of this progressive industry, you’ll have the chance to interact with professionals from various disciplines, building valuable connections and expanding your network.

The potential for mentorship, learning, and advancement is immense, empowering you to shape a fulfilling and rewarding career trajectory.

Top 20 High-Paying Jobs In Real Estate Investment Trusts

Given that real estate investment trusts are a diverse industry, the following list is not a comprehensive presentation of all careers available in the field. Instead, it’s a sampling of the highest-paying positions available with REITs.

Since no career information is available on the Bureau of Labor Statistics website specific to real estate investment trusts, the information contained in the descriptions below is summarized from listings appearing on Indeed.com.

Indeed has the advantage of publishing job listings from multiple job boards, offering the largest selection of positions in almost any career category. Similar to Indeed, sites like Zip Recruiter also help you find the best jobs in REITs.

Be aware that the specific salary you may earn will depend on your own qualifications and experience, the size of the REIT, and its geographic location.

1. Chief Executive Officer (CEO)

Salary Range: $250,000 and up, based on the size of the REIT

Qualifications:

A CEO typically has a minimum of a Master of Business Administration (MBA) degree and may hold a related degree, like a law degree.

Rising to the level of CEO requires many years of experience in the REIT field.

The candidate should have come through the ranks of one or more previous REITs, holding various positions, including Chief Operating Officer.

What Is It?

The CEO is the highest-ranking individual in a typical organization, including a REIT. All other employees in the operation report to the CEO, who is responsible for making major decisions affecting the trust.

The CEO position is required to represent the interests of the investors in the REIT ultimately. That means ensuring the trust remains profitable and can continue paying dividends to shareholders regularly.

2. Chief Operating Officer (COO)

Salary Range: $150,000 to $350,000

Qualifications:

The education requirements for a COO are similar to those of a CEO.

The candidate must also bring many years of experience in the REIT industry, holding other high-ranking positions in previous REITs. That will include a demonstrated capability to grow a REIT while increasing profits.

What Is It?

The COO is the highest-ranking officer in a REIT at the operations level.

The COO oversees the entire operation and has charge over other positions within the trust. That will involve regular interaction with top management and making critical decisions about the operation and profitability of the trust.

The holder of the position ultimately reports to the CEO.

3. Chief Financial Officer (CFO)

Salary Range: $75,000 to $200,000

Qualifications:

Typically, a minimum of an MBA with a concentration in finance is strongly preferred. Status as a certified public accountant or certified financial advisor is often required.

The candidate will need at least five years in a high-level financial management capacity, with previous real estate experience as a major plus.

What Is It?

The CFO is the top position in the financial chain of a REIT.

The position oversees other financial departments, including financial analysts, accountants, the finance department, and other finance professionals and operations.

CFOs report directly to the CEO and the COO and will generally be required to travel regularly.

4. Director Of Asset Management

Salary Range: $125,000 to $158,000

Qualifications:

Experience in portfolio or asset management, particularly large real estate portfolios. A college degree in real estate, finance, or a related major is typically required.

Most positions will involve much travel, particularly with multi-city portfolios.

What Is It?

This is an investment portfolio manager for real estate investment trusts. The director will manage a portfolio of properties and work closely with most other professionals in the REIT.

The candidate must profitably manage properties within the portfolio and regularly report results to upper management and investors.

5. Real Estate Attorney

Salary Range: $100,000 to $150,000

Qualifications:

Requires a law degree and experience as a real estate attorney. Experience in commercial real estate law will be strongly preferred. The position is likely to require a substantial amount of travel.

What Is It?

Depending on the organization, the position goes by different names, such as chief legal counsel.

A real estate attorney will be responsible for reviewing legal documents for the trust and representing the trust in negotiations with investors and during property acquisitions.

He or she may also be required to research and provide legal opinions for upcoming property acquisitions or defend the REIT against lawsuits.

6. Real Estate Acquisitions Specialist

Salary Range: $80,000 to $150,000

Qualifications:

Minimum of a bachelor’s degree in real estate, business, or a related field. You should also have a proven track record in sales, including at least some experience in the real estate field.

What Is It?

As the name implies, a real estate acquisitions specialist helps the REIT locate properties to purchase for the trust.

The position involves working with potential property sellers and preparing documents necessary for acquisition. It involves a large number of sales and is likely to require travel.

7. Investor Relations Manager

Salary Range: $90,000 to $110,000

Qualifications:

A college degree in real estate, finance, marketing, or a related field is preferred.

But more important is experience in financial services, wealth management, or private banking, especially working with high-net-worth investors. That includes account management experience. Direct real estate experience is always a plus.

What Is It?

As investment trusts, REITs rely on investors’ inflow of investment funds. The investor relations manager facilitates that process.

The candidate will work to raise investment funds from both new and existing investors and provide contact and management for those accounts.

8. Financial Analyst

Salary Range: $75,000 to $95,000

Qualifications:

Requires a bachelor’s degree in finance, accounting, or a related major. Should have previous experience as a financial analyst, and prior real estate experience is strongly preferred.

What Is It?

Financial analysts prepare and distribute financial reports periodically. The position typically requires budget planning, forecasting, and strategic initiatives.

The analyst will work closely with other professionals in a REIT organization and may report directly to upper management.

9. Commercial Real Estate Appraiser

Salary Range: $70,000 to $90,000

Qualifications:

A candidate must be licensed as a commercial real estate appraiser in any state where he or she will be performing property valuations. That typically requires completing certain coursework and passing a unified exam.

The candidate will also need several years of experience appraising the type of properties a REIT invests in.

What Is It?

A commercial real estate appraiser provides an evaluation of properties a REIT may be interested in acquiring.

The appraiser will need to determine a property’s value using various methods, including market value, replacement cost, and rental value.

The appraiser may also be called upon to determine the approximate cost of renovations to properties that need to be upgraded.

10. Real Estate Investment Analyst

Salary Range: $55,000 to $85,000

Qualifications:

A college degree in a related field is helpful, but the position really requires relevant experience. That includes a thorough understanding of the real estate industry and specific local markets, as well as investment risk and real estate investment viability.

What Is It?

A real estate investment analyst researches industry market data, including relevant economic, demographic, and location analysis.

You’ll be required to prepare presentations and reports based on that analysis and may be called upon to locate potential properties.

11. Tax Specialist

Salary Range: The average salary for a tax specialist in the REIT industry ranges from $80,000 to $120,000 per year, depending on experience and location.

Qualifications:

A bachelor’s degree in accounting or finance is typically required. Professional certifications such as Certified Public Accountant (CPA) or Certified Tax Specialist (CTS) are highly valued.

What Is It?

A tax specialist in the Real Estate Investment Trust (REIT) industry is responsible for managing tax compliance, analyzing tax implications, preparing tax returns, and providing tax planning advice.

12. Transaction Analyst

Salary Range: The average salary for a transaction analyst in the REIT industry is around $90,000 to $130,000 per year, depending on experience and location.

Qualifications:

A bachelor’s degree in finance, real estate, or a related field is usually required. Strong analytical skills, knowledge of real estate valuation methods, and proficiency in financial modeling software are necessary.

What Is It?

A transaction analyst evaluates and analyzes real estate investment opportunities, conducts due diligence, performs financial modeling, and prepares investment reports for decision-making.

13. Survey Researcher

Salary Range: The average salary for a survey researcher in the REIT industry ranges from $70,000 to $100,000 per year, depending on experience and location.

Qualifications:

A bachelor’s degree in market research, statistics, economics, or a related field is typically required. Proficiency in survey methodologies, data analysis tools, and strong analytical skills are essential.

What Is It?

A survey researcher in the REIT industry conducts market research and surveys to gather data and insights on real estate trends, investor preferences, and market demand.

14. Supervisor

Salary Range: The average salary for a supervisor in the REIT industry ranges from $80,000 to $120,000 per year, depending on experience, location, and the size of the organization.

Qualifications:

A bachelor’s degree in business administration, real estate, or a related field is typically required. Relevant experience, leadership skills, and strong organizational abilities are important qualifications for this role.

What Is It?

A supervisor in the Real Estate Investment Trust (REIT) industry oversees and manages a team of professionals involved in various aspects of real estate operations, such as property management, leasing, maintenance, or finance. They provide guidance, set goals, and ensure efficient operations.

15. Service Associates

Salary Range: The average salary for service associates in the REIT industry ranges from $45,000 to $70,000 per year, depending on experience, location, and the size of the property.

Qualifications:

A high school diploma or equivalent is typically required. Strong communication skills, customer service experience, and knowledge of property management processes are important qualifications for this role.

What Is It?

Service associates in the REIT industry are responsible for managing tenant relations and ensuring tenant satisfaction. They handle inquiries, address tenant concerns, coordinate maintenance requests, and facilitate lease renewals.

16. Leasing Consultants

Salary Range: The average salary for leasing consultants in the REIT industry ranges from $50,000 to $80,000 per year, depending on experience, location, and the size of the property.

Qualifications:

A high school diploma or equivalent is typically required, though some employers may prefer candidates with an associate’s or bachelor’s degree in business, real estate, or a related field. Strong sales skills, excellent communication abilities, and knowledge of leasing processes and regulations are important for this role.

What Is It?

Leasing consultants in the REIT industry play a crucial role in attracting and securing tenants for REIT-owned properties. They conduct property tours, respond to leasing inquiries, negotiate lease agreements, and provide information on available units.

17. Drafter

Salary Range: The average salary for a drafter in the REIT industry is around $50,000 to $80,000 per year, depending on experience, location, and specialization.

Qualifications:

An associate’s degree or certification in drafting or a related field is typically required. Proficiency in computer-aided design (CAD) software, knowledge of building codes and construction practices, and attention to detail are important qualifications for this role.

What Is It?

A drafter in the REIT industry creates detailed technical drawings and plans for real estate development and construction projects. They work closely with architects, engineers, and other professionals to produce accurate and precise drawings that guide construction processes.

18. REIT Broker

Salary Range: The average salary for a REIT broker varies widely based on commissions and deal volume, but it can range from $70,000 to $150,000 or more per year.

Qualifications:

A bachelor’s degree in business, finance, or real estate is typically required. State licensure as a real estate broker and relevant experience in real estate sales and transactions are important qualifications for this role.

What Is It?

A REIT broker specializes in facilitating real estate transactions involving REITs. They represent buyers, sellers, or investors in buying, selling, or leasing REIT-owned properties. They provide market analysis, negotiate deals, and handle contract documentation.

19. Compliance Officer

Salary Range: The average salary for a compliance officer in the REIT industry ranges from $80,000 to $150,000 per year, depending on experience, location, and the size of the organization.

Qualifications:

A bachelor’s degree in business, finance, law, or a related field is typically required. Knowledge of applicable laws and regulations, strong analytical skills, attention to detail, and the ability to effectively communicate and educate employees on compliance matters are important for this role. Professional certifications such as Certified Compliance and Ethics Professional (CCEP) or Certified Regulatory Compliance Manager (CRCM) are advantageous.

What Is It?

A compliance officer in the Real Estate Investment Trust (REIT) industry ensures that the company complies with relevant laws, regulations, and internal policies. They develop and implement compliance programs, conduct audits, and provide guidance to employees on compliance matters.

20. Portfolio Manager

Salary Range: The average salary for a portfolio manager in the REIT industry ranges from $100,000 to $200,000 or more per year, depending on experience, location, and the size of the portfolio.

Qualifications:

A bachelor’s or master’s degree in finance, real estate, or a related field is typically required. Strong financial analysis skills, knowledge of real estate markets, experience in asset management, and the ability to make strategic investment decisions are important qualifications for this role. Professional certifications such as Chartered Financial Analyst (CFA) or Certified Commercial Investment Member (CCIM) are highly valued.

What Is It?

A portfolio manager in the REIT industry is responsible for managing and optimizing a portfolio of real estate assets. They oversee property acquisitions, disposals, and leasing strategies. They analyze market trends, assess risks, and develop investment strategies to maximize returns for investors.