Ethereum (ETH-USD) finds itself at a pivotal juncture, with the Securities and Exchange Commission (SEC) taking significant steps that could shape the future of cryptocurrency investments. The focus on Ethereum ETFs underscores the growing interest and potential for broader acceptance within the investment community.

SEC Seeks Public Insight

The SEC has initiated a 21-day comment period for Ethereum ETF applications from industry heavyweights Grayscale, Fidelity, and Bitwise. Critical in the evaluation process, this step aims to gauge public sentiment and concerns regarding these proposed investment vehicles. The call for public comments is a procedural formality and a vital part of ensuring that the introduction of Ethereum ETFs aligns with investor interests and market integrity.

With the May 23 deadline for a final decision on VanEck’s Ethereum ETF application approaching, not many in the crypto space expect it to be approved. Recent SEC actions, including inquiries into the Ethereum Foundation, have cast a shadow of uncertainty over the immediate prospects of Ethereum ETFs. Analysts, while hopeful, prepare for the possibility of a delay beyond the May deadline.

A Strategic Pause for Ethereum?

Despite prevailing doubts about a timely approval, not all industry voices view potential delays as a setback. Matt Hougan, Bitwise’s Chief Investment Officer, presents an intriguing perspective, suggesting that a more gradual integration of Ethereum-based products could benefit the traditional finance (TradFi) sector. Allowing the market to acclimate to Bitcoin ETFs before introducing Ethereum offerings might pave the way for a smoother transition and broader acceptance.

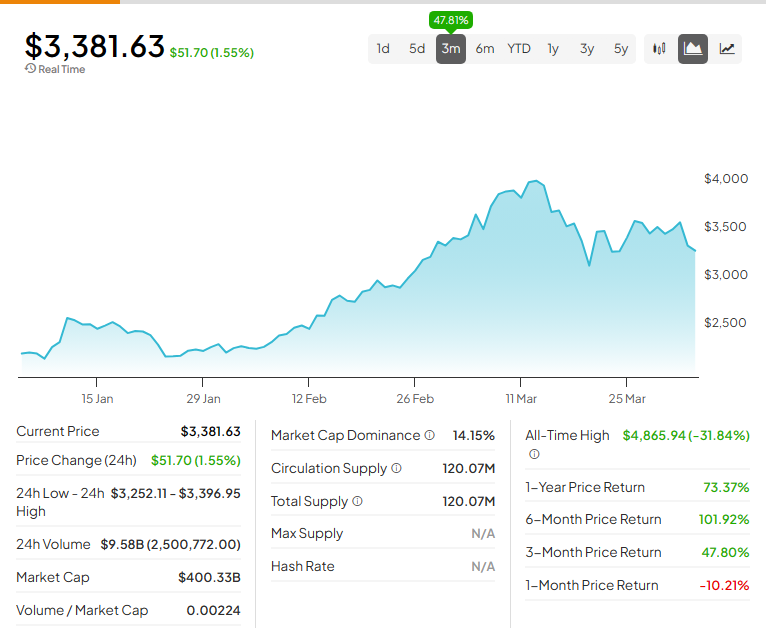

On the trading front, Ethereum’s price dynamics offer a mixed picture. The cryptocurrency has declined nearly 12% this week, yet it remains above the March lows near $3,050. Traders are closely monitoring the $2,850 support level, aware that regulatory developments could trigger significant market movements.

Don’t let crypto give you a run for your money. Track coin prices here