Branded is a weekly column devoted to the intersection of marketing, business, design, and culture.

Gold is a hot commodity lately. Spot prices hit a peak this week, attributed to geopolitical jitters and uncertainty about a potential Fed rate cut. Those are traditional inspirations for a gold rush, but these days potential goldbugs have a venue other than the usual markets: Costco.

The discount club chain has seen its share price jump 46% over the past year on rising sales and a recently boosted dividend. Last summer, it introduced bullion to its familiar sprawling mix of huge jars of mayonnaise, bulk toilet paper, and other jumbo versions of grocery and household staples, selling for around $2,000 per ounce. And a good chunk of its shoppers have taken a shine to it: Wells Fargo recently estimated that Costco may be selling $100 million to $200 million in gold bars a month.

That’s an eye-catching number, given that Costco reported $100 million in gold-bar sales for the entire quarter ending last November. “Aggressive pricing and a high level of customer trust” have boosted sales since then, Wells Fargo said in a note to investors, cited by CNBC. “The accelerating frequency of Reddit posts [and] quick on-line sell-outs . . . suggest a sharp uptick in momentum since the launch.”

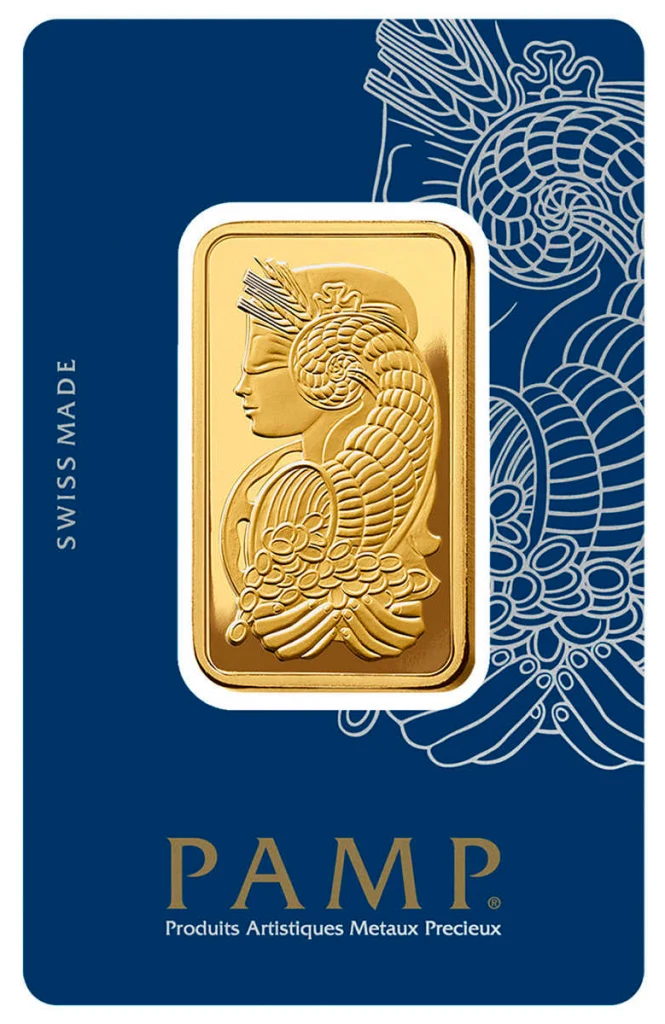

The actual gold comes in one-ounce bars of PAMP Suisse Lady Fortuna Veriscan, about two inches long and stamped with an image of the Roman goddess of prosperity. While available (at least intermittently) at a select number of physical Costco Warehouse locations, most of the gold bars sell online in batches—limit five per customer—and seem to go quickly. Like the price of gold generally, the cost of a bar from Costco fluctuates, but appears to be pegged at about 2% over the spot price.

For buyers, the big-box retailer is an accessible and trustworthy venue for one of the most venerable forms of value storage known to humanity. In recent years, gold is often promoted as a potential hedge against market uncertainty—albeit one that might be more familiar as a strategy touted on vaguely alarming talk-show ads, starring Ron Paul or Steve Bannon.

But of course, gold carries risks like any investment. (JPMorgan, noting part of the commodity’s recent rise to “retail investors and speculative institutional investors,” suggests energy as a better hedge.) Other downsides: gold is volatile; its track record as an investment isn’t stellar; and while it’s not clear how easy it would be for an individual to sell physical gold bars for their full value, it will likely be harder than it was to buy them online.

That said, Costco’s cash-back premiums for its “executive” club members and users of certain credit cards make Costco an even more attractive seller. But that raises a different question. Given that the chain (with annual revenue in the $248 billion range) is evidently taking in thin profits on the bars, why does it bother?

One answer is that Costco, like any big retailer, needs fresh and creative reasons to remind consumers of its wide array of offerings and competitive prices—and gold is just the latest shiny object it’s using to deliver that message. You can also buy gold on Amazon or Walmart’s site, but in addition to buzz on Reddit and Facebook, it’s hard to resist the image of a Costco shopper tossing a gold bar into the cart “next to a seven-pound bag of frozen chicken and a carton of Kirkland eggs,” to cite once scene described by the Wall Street Journal recently. Lately, the warehouse club has even added silver coins to the mix. (Silver has also been on a tear.)

In a way, the Costco precious metals are a glimmering cousin of arguably its most famous offering: the $1.50 hot dog (which it has famously held steady despite inflation). Once coaxed into paying $60 to $120 in annual membership fees, the typical Costco member spends more than $3,000 a year, estimates the analytics firm Numerator. Like the bargain meal, Costco’s gold rush is less about driving profits than it is about drawing shoppers to its stores and site, where there’s plenty more “treasure hunting”—as the company calls an ever-changing mix of bargains—to be had. As a publicity tactic for grabbing headlines and attention, it’s worth its weight in . . . well, you know.