Aave (AAVE-USD), a leading force in the decentralized finance (DeFi) sector, is considering adopting a significant operational change that could reshape its relationship with token holders. With the proposal of a “fee switch,” Aave is positioning itself to distribute its substantial net profits directly to its stakeholders, marking a pivotal moment in the platform’s governance and economic model.

Empowering Token Holders with Fee Distribution

As one of the cryptocurrency market’s primary decentralized lending platforms, AAVE is known for facilitating loans in cryptocurrencies with another digital asset as collateral. AAVE operates under the governance of its token holders through the Aave DAO. This structure ensures that AAVE token holders collectively drive the platform’s strategic decisions. The proposed ‘fee switch’ initiative, revealed by Marc Zeller of the Aave Chan Initiative, aims to distribute part of Aave’s annual net profits back to its token holders—currently standing at approximately $60 million.

Historically, DeFi platforms have explored various mechanisms to reward their communities. Aave’s fee switch proposal aligns with trends in other leading protocols, such as Uniswap (UNI-USD) and Frax Finance, which recently revisited its fee distribution policies.

Adjusting to DeFi’s Evolving Landscape

Furthermore, Aave’s governance discussions extend beyond fee distribution to encompass broader risk management strategies, such as the Dai (DAI-USD) collateral restrictions debate. Proposals to adjust DAI’s loan-to-value ratios underscore the platform’s commitment to balancing operational flexibility with financial prudence.

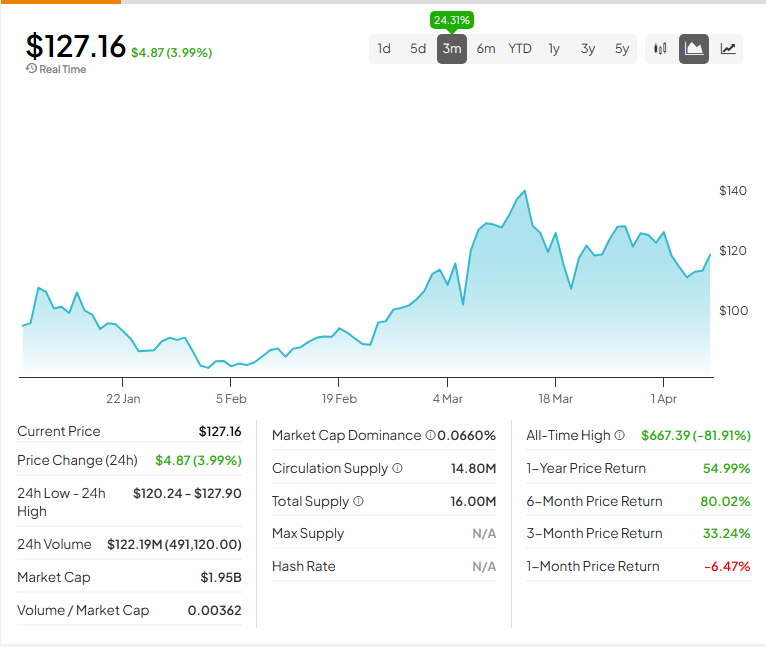

AAVE’s performance in 2024 thus far lags behind the majority of the crypto market. Year-to-date, AAVE is up by +16.16%, which represents only a marginal increase compared to the rest of the market. Year-over-year, AAVE stands relatively in the middle of the pack with a +147% gain.

Don’t let crypto give you a run for your money. Track coin prices here