Are you curious how much student loan debt members of Congress actually owe?

Given that Congress is responsible for creating the laws and policies surrounding student loan debt, we wondered – how much student loan debt do members of Congress actually have?

Since they are supposed to be “representatives” of the country – can members of Congress actually relate to the struggles of millions of student loan borrowers in this country?

Student loan debt (and higher education policy in general) is complex, nuanced, and has lots of moving parts. Unless you’ve lived through borrowing to pay for college and navigating repayment after college, it’s nearly impossible to relate.

So, we spent the last few months going through the most recent financial disclosures for every member of Congress, and we’re what we found out.

Editor’s Note: Some content in this article has been updated to reflect the end of the student loan payment pause.

Student Loan Debt Statistics

Let’s start by putting some context into the current student loan debt crisis.

Here is where student loan debt currently stands. There are 45 million Americans with roughly $1.7 trillion in student loan debt. According to the US Census, there are currently about 332,400,000 people in the United States, so that means 13.5% of all Americans have student loan debt currently.

However, if you want a better metric, there are 258,000,000 adults in the United States (because you won’t have student loans if you’re under 18). So, that means 17.4% of adults in the United States have student loan debt currently.

Here are some other statistics to consider:

- Average student loan debt: $39,351

- Median student loan debt: $19,281

- Average student loan monthly payment: $393

- Median monthly payment on student loan debt: $222

- Percentage of borrowers with growing loan balances: 47.5%

- Percentage of borrowers who are more than 90 days delinquent: 4.67%

- Average debt load for 2021 graduates: $30,600 (see the average student debt by graduating class here)

It’s also important to remember that student loan payments were paused from March 2020 through August 2023. But total student loan balances are growing because each year new college students are entering college or finishing school and adding to the total loan balance.

Let’s see how this compares with Congress.

Overall View Of Student Loan Debt In Congress

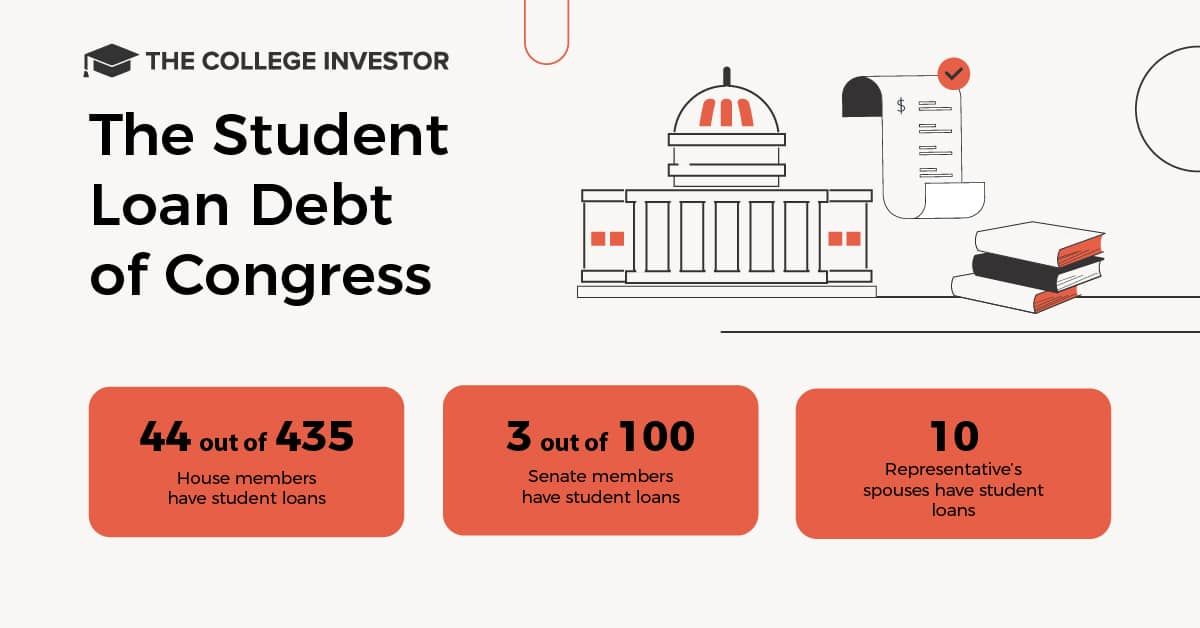

In analyzing the most recent financial disclosure statements (through 2022) for all members of Congress, we found that:

- 44 members in the House of Representatives have student loans in their household (this includes both loans they individually borrowed and loans they may be co-signers for their children on)

- Of the 44, ten of the Representatives’ spouses had student loans

- 3 members in the Senate have student loans, with one of them belonging to their spouse

When you start comparing Congress to the American population as a whole, the number of Congressmen with student loans is a below-average representation of America.

- Only 10.1% of the House of Representatives has student loan debt, vs. 13.5% of Americans

- Only 3% of the Senate has student loan debt, vs. 13.5% of Americans

It does appear that the median amount of student loan debt reported by Congress does align (and actually skews a little higher) than the average American – with 24 members of Congress reporting between $15,001 and $50,000 in student loan debt in their household. Here’s what members of Congress reported as their balance of student loans via their financial disclosure statements:

Important Note: Only balances above $10,000 are reported. There may be more members with balances below this amount.

During our research, we also discovered that six Representatives had paid off or eliminated their student loan debt since their 2019 financial disclosure. Those members are:

- Rep. Tony Cardenas (D-CA-29)

- Rep. Andre Carson (D-IN-7)

- Rep. Jody Hice (R-GA-10)

- Rep. Conor Lamb (D-PA-17)

- Rep. Jimmy Panetta (D-CA-20)

- Rep. Raul Ruiz (D-CA-36)

Let’s break it down by each chamber of Congress.

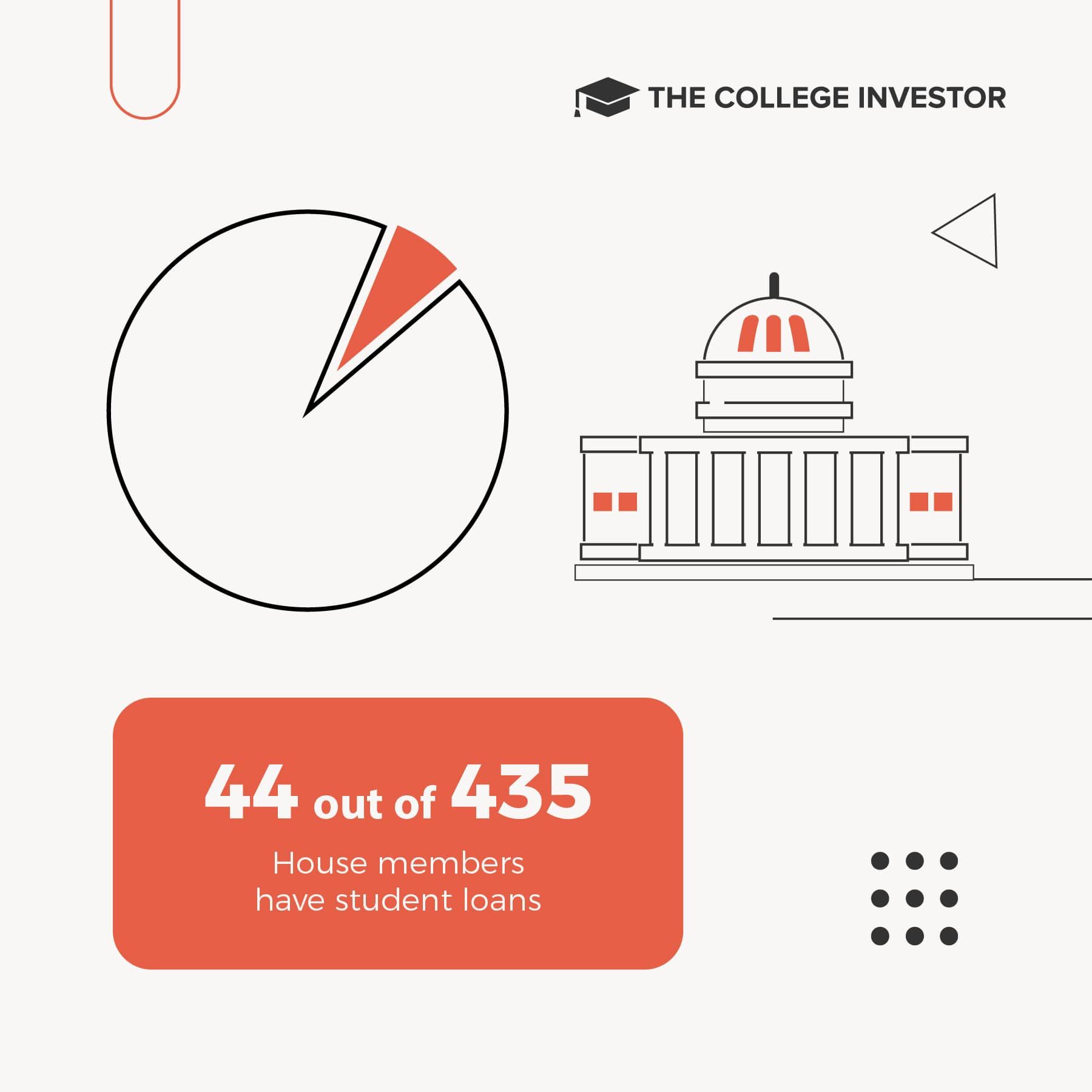

Which Members Of The House Of Representatives Have Student Loan Debt?

In the House of Representatives, 44 out of 435 members have student loans in their households. Of this, the only student loans for 10 members belonged to their spouse.

This represents 10.1% of House members having student loans in their household.

The median amount of student loan debt reported by members in the House is $15,001 to $50,000. It’s important to note that many members who’ve borrowed student loans pursued some advanced degrees. It’s also important to remember that a “regular” House member’s salary is currently $174,000 per year (though they likely have higher expenses than most Americans as well).

Finally, I’m sure someone will want the partisan breakdown, so here you go:

- 26 Democrats have student loans

- 18 Republicans have student loans

Here’s a full breakdown of who has student loans in the House of Representatives, along with some notes about who the student loan may be for (such as a spouse, or a co-signed loan for a child).

The average age of a student loan borrower in the House of Representatives is 50, and on average they have two children. Age and children can be a good insight as to whether the student loan is their own, or whether the loan is for their children. Some members of Congress disclose this on their statements, but many do not, so we wanted to include it.

|

Rep. Nanette Barragan (D-CA-44) |

||||

|

Co-Signer for Private Loans |

||||

|

Rep. Gus Bilirakis (R-FL-12) |

Co-Signer for Private Loans |

|||

|

Rep. Brendan Boyle (D-PA-2) |

||||

|

Rep. Salud Carbajal (D-CA-24) |

||||

|

Rep. John Carter (R-TX-31) |

Co-Signer for Private Loans |

|||

|

Rep. Gerry Connolly (D-VA-11) |

||||

|

Rep. Sharice Davids (D-KS-3) |

||||

|

Rep. Antonio Delgado (D-NY-19) |

||||

|

Rep. Byron Donalds (R-FL-19) |

Both Rep & Spouse Loans |

|||

|

Rep. Veronica Escobar (D-TX-16) |

Both Rep & Spouse, and Cosigner for Private Loans |

|||

|

Rep. Michelle Fischbach (R-MN-7) |

||||

|

Rep. Scott Fitzgerald (R-WI-5) |

||||

|

Rep. Andrew Garbarino (R-NY-2) |

||||

|

Rep. Jared Golden (D-ME-2) |

||||

|

Rep. Jimmy Gomez (D-CA-34) |

||||

|

Rep. Josh Gottheimer (D-NJ-5) |

||||

|

Rep. Jahana Hayes (D-CT-5) |

||||

|

Rep. Mondaire Jones (D-NY-17) |

||||

|

Rep. Trent Kelly (R-MS-1) |

||||

|

Rep. Raja Krishnamoorthi (D-IL-8) |

||||

|

Rep. Sheila Jackson Lee (D-TX-18) |

||||

|

Rep. Kevin McCarthy (R-CA-23) |

||||

|

Rep. Tom McClintock (R-CA-4) |

||||

|

Rep. Stephanie Murphy (D-FL-7) |

||||

|

Rep. Joseph Neguse (D-CO-2) |

||||

|

Rep. Alexandria Ocasio-Cortez (D-NY-14) |

||||

|

Rep. Burgess Owens (R-UT-4) |

||||

|

Rep. Stacey Plaskett (D-USVI) |

||||

|

Rep. David Schweikert (R-AZ-6) |

||||

|

Rep. Jason T. Smith (R-MO-8) |

||||

|

Rep. Lloyd Smucker (R-PA-11) |

Co-Signer for Private Loans |

|||

|

Rep. Darren Soto (D-FL-9) |

||||

|

Rep. Greg Stanton (D-AZ-9) |

||||

|

Rep. Greg Steube (R-FL-17) |

||||

|

Rep. Eric Swalwell (D-CA-15) |

||||

|

Rep. Rashida Tlaib (D-MI-13) |

||||

|

Rep. Nikema Williams (D-GA-5) |

You can search the House Financial Disclosures here.

House Education and Labor Committee

The House Education and Labor Committee is the group within the larger House of Representatives responsible for spearheading higher education legislation, including any chances to student loan policy. This is the group that would debate the Higher Education Act re-authorization (which is the umbrella for most financial aid and student loan policies).

It’s currently composed of 53 members – 29 Democrats and 24 Republics.

Of those 53 members, only 6 members (11.3%) have student loan debt. 3 Democrats and 3 Republicans on the committee have student loans.

That means that the large majority of people making higher education policy do not have student loans.

Which Members Of The Senate Have Student Loan Debt?

Only 3 out of 100 Senators have student loans in their households. Of this, one of the Senator’s only reports student loans for their spouse.

This represents just 3% of the Senate having student loan debt in their household.

All three Senators who reported student loans in their households reported between $15,001-$50,000 in student loan debt. Again, each Senator receives an annual salary of $174,000 per year.

From a partisanship perspective, all three Senators with student loan debt are Democrats.

Here’s a full breakdown of who has student loans in the Senate, along with some notes about who the student loan may be for (such as a spouse, or a co-signed loan for a child).

|

Sen. Christopher S. Murphy (D-CT) |

||||

|

Sen. Kyrsten Sinema (D-AZ) |

You can search the Senate Financial Disclosures here.

Senate Committee on Health, Education, Labor, and Pensions

The Senate Committee on Health, Education, Labor, and Pensions is the group responsible for spearheading higher education legislation in the Senate. This is the partner of the group in the House that would also oversee higher education topics.

It’s currently composed of 22 members – 11 Democrats and 11 Republics. That represents 4.5% of the committee.

Of those 22 members, only 1 member (Sen. Christopher S. Murphy) has student loan debt.

What Does This Mean For Policy?

I think it’s interesting to see how many members of Congress have student loans, what balances they have, and who’s loans they may have because it gives you an idea of whether “does this person relate to my situation”.

When we’re having policy discussions on reforming student loans, student loan forgiveness, financial aid, and more, it’s important to understand if those in power and making policy even fully understand the whole scenario – the math and the psychology.

That’s not to say that people who don’t have student loans or needed financial aid can’t relate – but when we’re electing people to represent us, they should represent us – who we are, what we are. The House of Representatives is a much closer representation, with 10.1% of members having student loans, and a student loan balance close to the average.

However, the Senate is really skewed, with only 3 members (or 3%) having student loans. Not to mention that the median age in the Senate is 68 years old – that means the last time they had to make decisions around financial aid, paying for college, or student loans personally was in the early 1970s…

As we continue to ask our representatives to fix the higher education and student loan system, we also need to keep this relate-ability in mind – and maybe elect representatives that better reflect our circumstances.