If you’re planning on renting a car while traveling, you’ll want to make sure that you’re covered with insurance. Most rental car companies offer some coverage at an extra cost, but these options tend to be expensive. But affordable rental car insurance is out there — it just takes some effort to coordinate.

Here’s a look at how car rental travel insurance works, what it covers and other options for making sure you’re insured while on the road in a rented car.

Does travel insurance cover car rentals?

Yes, many travel insurance policies include some form of rental car coverage. If it’s not already included in your plan, there may be an option to customize coverage by adding rental car insurance.

Costs vary depending on the overall plan, the coverage limit of the rental car insurance and whether the insurance is primary or secondary.

🤓Nerdy Tip

Primary rental car coverage is the first entity to pay out; “secondary” means the insurance will only cover costs not already paid for by other policies. This is also known as car rental excess insurance, meaning that rental car excess insurance kicks in only after other coverage is exhausted.

If you own a car and have an insurance policy, check if you already have rental car coverage. In the U.S., personal car insurance tends to cover rentals.

Travel insurance on a rental car

When considering a specific travel insurance policy, comb through its plan documents to see what type of car rental coverage is included.

In general, rental car insurance provided by a travel insurance policy is limited. Unlike a personal car insurance policy or rental car insurance from a credit card, the plan likely won’t cover liability or medical expenses incurred in an accident.

Travel insurance policies often offer a collision damage waiver (CDW), which means that the damage your vehicle sustains in an accident will be reimbursed. CDWs may also include coverage for theft.

Some policies exclude specialty vehicles from coverage, while others won’t insure you for cars rented in certain countries.

Of course, it’s also possible to opt for the insurance offered by the rental car company, which can be a hassle-free way to ensure that you don’t end up on the hook in case of an accident.

Finding travel insurance with rental car coverage

To find a policy with rental car insurance, head to a travel insurance provider comparison sites like TravelInsurance.com or Squaremouth.

Here’s a search on Squaremouth as an example.

First, input your travel information, including when you’re departing, where you’re going, age and state of residence.

Then, the search engine will create a list of all available policies, which can be filtered to those that include rental car insurance.

Note that the terms of each policy can differ, especially how much coverage you’ll receive for a rental car.

Credit cards that offer travel insurance with rental car coverage

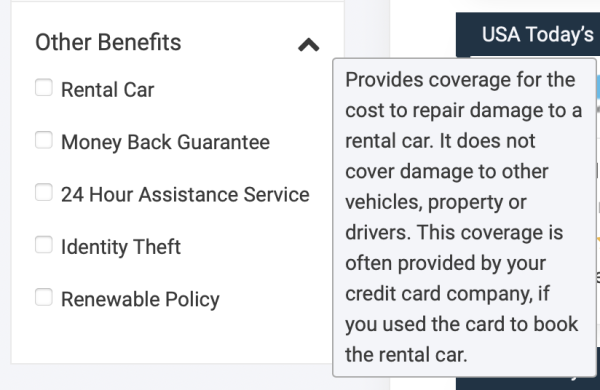

To get rental car insurance while traveling, you may first want to check your credit cards. Many credit cards offer complimentary rental car insurance for bookings charged to that card.

You’ll find this benefit on a variety of cards, including travel credit cards and cash back credit cards. Here are some options:

Rental car insurance coverage

Primary rental car coverage with reimbursement up to $75,000.

Primary auto damage collision damage waiver. New York residents are eligible only for secondary coverage.

Primary rental car coverage up to the cash value of most rental vehicles.

Primary coverage when renting for business purposes with reimbursement up to the actual cash value of most rental vehicles.

Travel insurance and rental cars recapped

It makes sense to look for a travel insurance policy that also covers a rental car, especially if you’re driving somewhere unfamiliar.

While it’s possible to purchase the insurance plans offered by the rental car company, these tend to be overpriced and overkill for many drivers. Instead, you could consider a travel insurance plan with included rental car coverage, which means you won’t have to without needing to make an additional purchase.

Also, check out any personal auto insurance policy you already have to see if it has provisions for rental cars. And before you settle on buying a travel insurance policy, double-check if a credit card you already have offers complimentary rental car insurance.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for: